Risk Management as a Service

INTRODUCING PANXORA’S

RISK MANAGEMENT AS A SERVICE

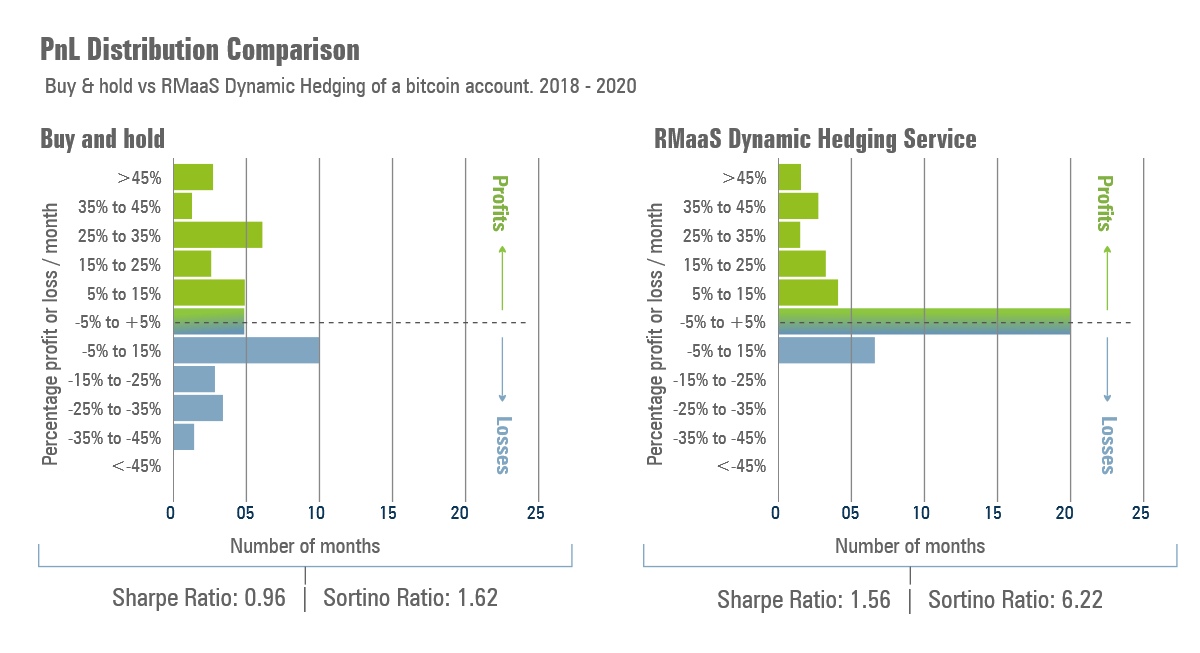

Panxora’s Risk Management as a Service – RMaaS – uses Panxora’s proven dynamic hedging models to successfully side step cryptocurrency’s downside volatility. This is the same dynamic hedging that protects the assets in our flagship hedge fund – Panxora Crypto I. The RMaaS allows investors to enhance the volatility protection on their cryptocurrency position without giving away any control over where and how their crypto-assets are held. RMaaS works with a client’s existing custodian and exchange accounts. The AI based hedging models monitor market activity 24/7. When they identify approaching market instability the RMaaS is designed to take appropriate hedging measures to protect the value of the assets. The service is tailored to meet each client’s specific requirements. We have connectors to most of the world’s leading custodians and exchanges. Our development team will accommodate counterparties that are not yet supported.

Bitcoin is at the start of a secular bull market that will offer Investment Managers and their clients a once in a generation opportunity to profit from an emerging asset class. Progressive corporations have recognized this potential and are already taking long term cryptocurrency positions to capitalise on the anticipated market uptrend. However, a recent Panxora Labs study shows that since 2013, when bitcoin started to become a viable trading asset, it has fallen by a minimum of 25% at least once in every calendar year. Often that fall averages more than 40% and this kind of drawdown makes cryptocurrency a challenging investment for those that have no way to manage this kind of volatility risk.