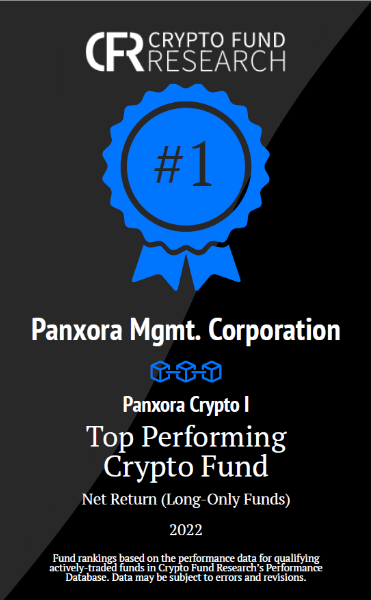

2022 has been a rough year for all cryptocurrencies. In fact, bitcoin, the cryptocurrency with the largest market cap lost nearly 65% of its market value by the end of the year. The market’s volatility and uncertainty has caused many investors that want to maintain a position in crypto to turn to hedge funds that specialize volatility management to manage their funds. One such fund, Panxora’s Crypto I Hedge Fund, has recently been recognized as the top performer of the year by Crypto Fund Research.

Panxora Crypto I is a quant hedge fund that uses a long-only, unleveraged approach to investment. This has been a winning strategy for the fund, that has proven to be successful even when the market is in a prolonged bear phase which it has been in since late 2021. This strategy has enabled the fund to outperform the market without exposing investors to excessive risk because of our focus on Risk Control.

“We believe that the cryptocurrency markets will provide an opportunity for significant growth for several more years,” stated Panxora’s GP and strategist Gavin Smith. “It is unnecessary to apply leverage to generate a handsome return for our clients and in fact can be counterproductive.”

Panxora Crypto I employs a rigorous quantitative approach to analyse trends and opportunities in the crypto market. The fund’s managers use sophisticated algorithms to identify and capitalize on opportunities for growth, moving the fund’s position into cash during periods of excessive volatility. The fund management’s policies concerning counterparty risk has allowed them to sidestep all of the major collapses that occurred in 2022 including Terra Luna, Celsius Network, BlockFi and FTX. This approach has enabled the fund to remain resilient in the face of market downturns, and to identify potential opportunities for profits even in bear markets.

For more information contact: