Right, so I’ve been wrestling with something crucial for our token project: demonstrating the strength and value of our community to potential investors. It’s not enough to just say we have a thriving community; we need cold, hard numbers. That’s where the article “Measuring Community Engagement: Key Metrics to Showcase to Investors” comes in – and let me tell you, it’s been a game-changer. I wanted to distil my experiences for anyone else trying to nail down the “Building a Strong Community & Online Presence” pillar of raising finance for a token. Think of this as me guiding you through the maze.

Laying the Foundation: Identifying Key Metrics

The article starts by hammering home the importance of identifying the right metrics. It’s easy to get lost in vanity metrics like total social media followers. While a large follower count looks good, it doesn’t necessarily translate to active engagement. The key is to focus on metrics that demonstrate genuine interaction and support. We zeroed in on these:

-

Social Media Engagement: This goes beyond followers. We’re tracking likes, comments, shares, and mentions across all platforms (Twitter, Telegram, Discord, etc.). We’re also monitoring the sentiment of these interactions – are people generally positive, negative, or neutral about our project?

-

Active Users: How many people are actively participating in our community spaces? We’re tracking daily and monthly active users on our Discord server, forum (if you have one), and any other relevant platforms.

-

Forum Participation: This one’s gold, if you’re running a forum. We’re tracking the number of new threads created, replies posted, and the overall activity level of the community. High participation suggests a genuinely engaged and invested audience.

-

Sentiment Analysis: This is where things get interesting. We use tools to analyse the text of social media posts, forum comments, and other online mentions to gauge the overall sentiment towards our project. This gives us a sense of whether people are happy, concerned, or critical.

Tools of the Trade: Tracking and Analysing Data

Okay, so we’ve identified our metrics. Now, how do we actually track and analyse them? The article opened my eyes to the range of tools available, some free, some paid. Here’s what we’re using:

-

Social Media Analytics Tools: Platforms like Hootsuite, Buffer, and Sprout Social offer comprehensive social media analytics. They track engagement metrics, sentiment, and even competitor activity. Most platforms offer their own analytics too (Twitter, Facebook, LinkedIn etc).

-

Discord Analytics: Several Discord bots (like Statbot or Community Analytics) can provide detailed insights into server activity, including active users, message frequency, and channel participation. These are easily installed and very affordable.

-

Sentiment Analysis Tools: We’re currently experimenting with several sentiment analysis APIs, including MonkeyLearn and Lexalytics. These tools use natural language processing (NLP) to analyse text and determine the overall sentiment. There are many providers, so shop around. Free trials are often available.

-

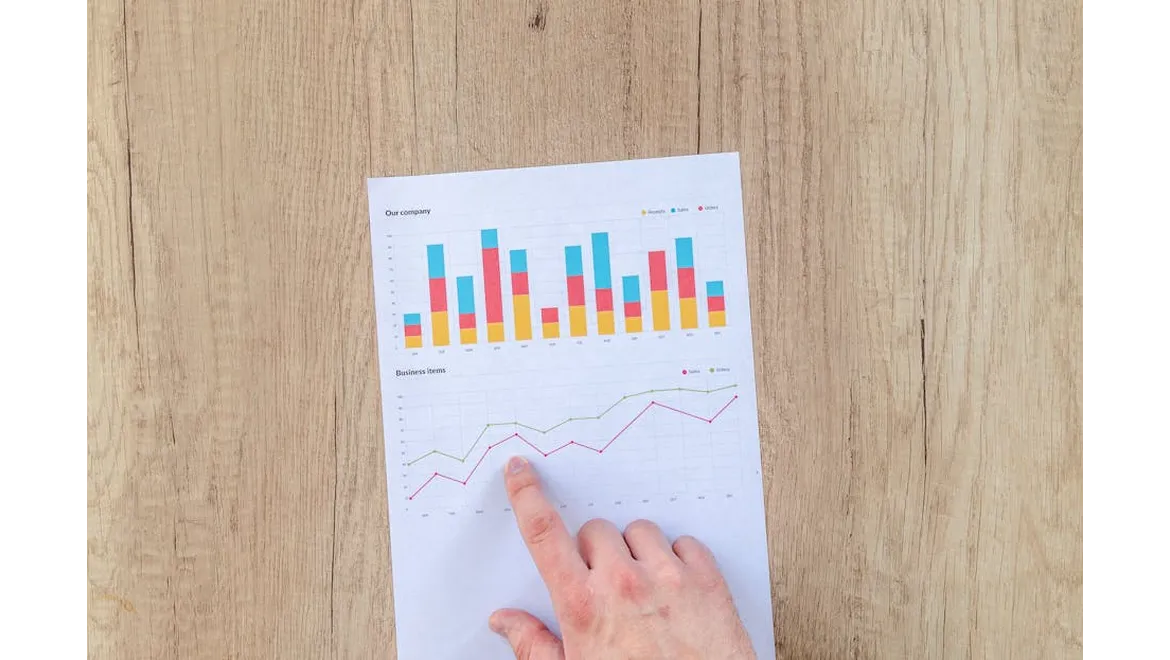

Spreadsheets (Old Faithful): Don’t underestimate the power of a good old spreadsheet. We use Google Sheets to consolidate data from various sources, create charts and graphs, and track our progress over time. This allows us to see trends and identify areas for improvement. Import the data and create charts.

Showcasing Community Strength: Presenting Data to Investors

The final piece of the puzzle is presenting this data to potential investors in a compelling and persuasive way. Here’s what I’ve learned:

-

Visualise the Data: Investors are busy people. They don’t want to wade through endless spreadsheets. Use charts, graphs, and infographics to present your data in a visually appealing and easy-to-understand format.

-

Tell a Story: Don’t just present the numbers. Tell the story behind them. Explain why these metrics are important and what they mean for the project. For example, you could say, “Our active Discord user base has grown by 30% in the last quarter, indicating increasing interest and engagement in our project.”

-

Highlight Key Milestones: Showcase significant achievements in community growth. For example, if you successfully onboarded 1,000 new members in a single week, or if you organised a hugely successful community event, make sure to highlight it. Evidence of success is key.

-

Be Transparent and Honest: Don’t try to inflate your numbers or hide negative trends. Investors will see through it. Be honest about your challenges and explain how you’re addressing them. Nobody expects perfection, just a solid plan.

-

Contextualise the Data: Don’t just show the numbers, provide context. Compare your community growth to similar projects or to industry benchmarks. This helps investors understand the significance of your achievements and where you stand relative to your competitors. Showing growth relative to a baseline is far more powerful than raw figures.

So, armed with this knowledge and the tools mentioned, I’ve been able to craft a compelling narrative about our community. Remember the importance of focusing on engagement over vanity, utilising the right tools to track and analyse, and presenting your findings transparently. This all helps in demonstrating the genuine strength of our token project to investors. It’s not just about the technology; it’s about the people who believe in it. Prove you have those people, and the financing will follow.