by Panxora Hedge Fund GP Marcie D. Terman

What Has Changed, What Hasn’t, and What Founders Need to Know

A Market of Two Eras

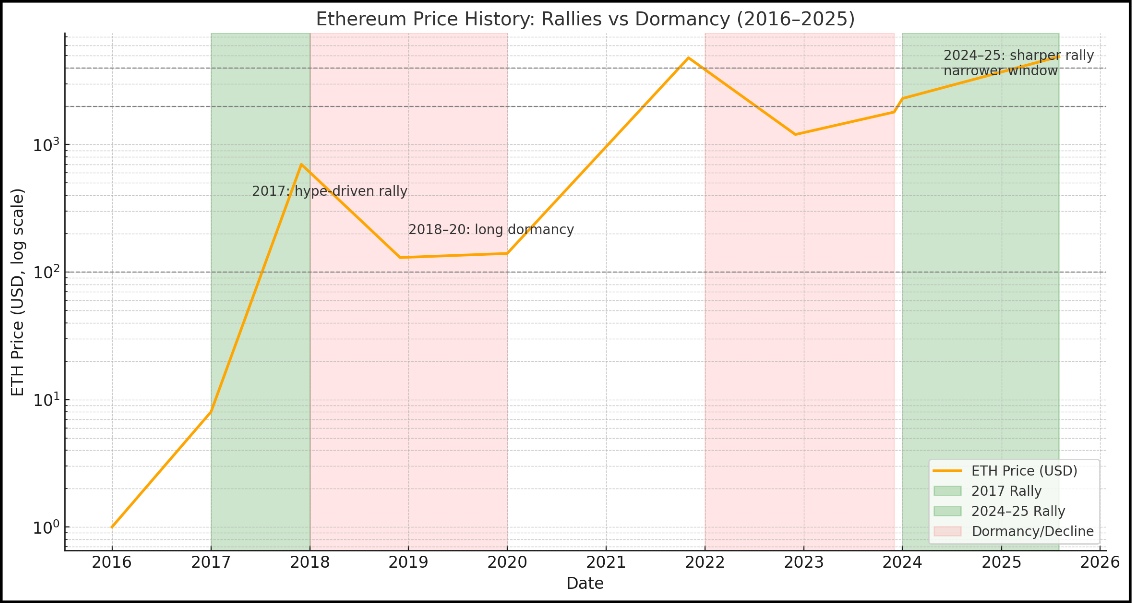

Token launches are shaped as much by market cycles as by innovation. The difference between launching in 2017 and launching in 2025 illustrates how conditions define strategy, opportunity, and risk.

- 2017: Ethereum climbed from under $15 to more than $700 in a single year. Investor enthusiasm was extraordinary, and capital was plentiful. Tokens with little more than a whitepaper and a Telegram group were able to raise substantial sums. I had the good fortune to lead a launch in that environment, and while it was highly successful, the market itself made the process easier than it would be today.

- 2025: Ethereum has again rallied, trading near $4,900 at the start of the year. Institutional inflows, ETF approvals, and renewed interest in DeFi have generated momentum. The difference is that investors are now far more discerning. Many have learned from past losses, regulators are more involved, and the bar for projects is much higher.

Market spikes in both eras create the most favourable conditions for fundraising, but the standards and expectations have changed dramatically.

What 2017 Taught Us

The 2017 cycle demonstrated how quickly attention and capital can flood into blockchain. But it also revealed the fragility of projects that raised without substance. Community was treated as an afterthought; speculative hype and buying fake profiles was enough to seed a project. When the market turned, projects without real, committed supporters collapsed.

The lesson: raising capital is the beginning, not the end. Without traction, utility, and genuine community, capital alone cannot sustain a token.

Launching in 2025

Today’s environment requires discipline:

- Community in place before launch. Investors now expect to see a user base and an engaged audience well before tokens trade. Projects cannot afford to “build it later.”

- Proof of utility. Tokenomics must make sense, and there must be a clear reason for the token to exist within the project’s economy.

- Execution readiness. Launching into a favourable market spike is still advantageous, but timing only matters if the fundamentals are ready to withstand scrutiny after the hype subsides.

In short: the window of opportunity is narrower, but projects that meet higher standards can attract not just early capital, but long-term commitment.

Community as the Foundation

Perhaps the greatest difference between 2017 and 2025 is the centrality of community. A project with a committed, authentic base of supporters has resilience in downturns, credibility with investors, and the ability to grow organically. A project without community is exposed to volatility and rapid decline once speculative attention fades.

For founders, this means the real work starts months before a token event. Community-building is not a marketing exercise — it is the bedrock of token success.

Conclusion

Launching in 2017 was defined by favourable conditions and forgiving investors. Launching in 2025 requires preparation, substance, and strategy. The similarity between the two eras is that market spikes remain the best moment to attract attention and capital. The difference is that only projects with strong fundamentals and established communities will thrive once the initial excitement fades.

At Panxora, our experience across both cycles has shown us the value of timing, discipline, and execution. The opportunity in 2025 is real — but it belongs to founders who treat the launch not as a one-time event, but as the culmination of careful preparation.